You can be confident that your payments are being processed in accordance with the latest 3DS v2.2 protocol and PSD2/SCA requirements.

Acquirer Processing

Top tier acquirer processing platform for banks and financial institutions running Mastercard/Visa Acquiring and Issuing programmes

Get in touch

SLA: 99.99% uptime

High-availability payments infrastructure ensures uninterrupted operation of your services 24/7/365

Unlimited personalisation

Want to go beyond the standard solution? We can adjust our service to your specifications in a matter of weeks

Faster service launch

Skip unnecessary bureaucracy and delays. We can fast track your market entry so you’re ready in as little as just 2 months

Industry Expertise

Serve diverse industries with customized payment solutions, from Fintech to eCommerce, ensuring seamless integration and onboarding

Customer confidence means sales and profits

Give your customers total payment confidence by accepting and processing every type of transaction securely and reliably with DECTA Acquirer Processing services

Acquirer Processing Solutions

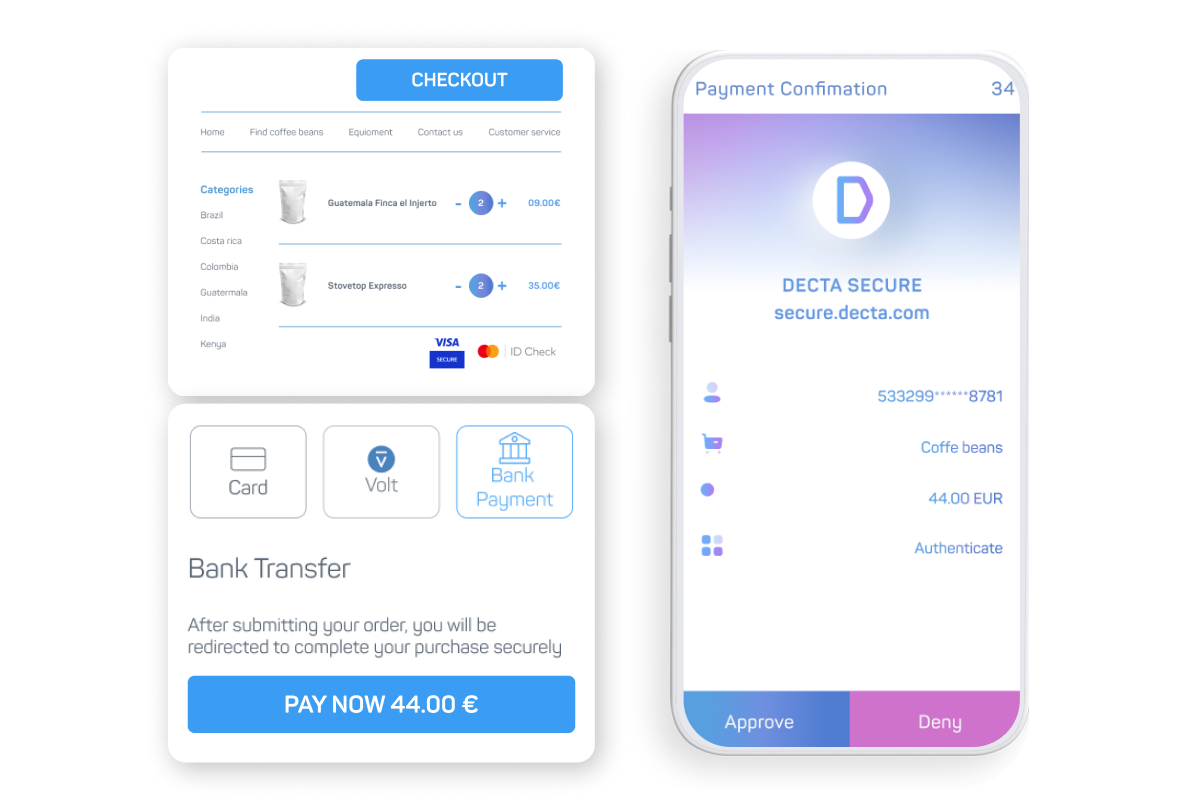

3D Secure Payment Authentication

- Mitigate fraud risk and add an extra layer of cardholder payment protection

- Improve payment acceptance, cardholder experience and reduce cart abandonment rate with SCA exemptions

- Enable merchants to set SCA thresholds on low-risk transactions to minimise customer friction and maximise conversions

Tokenized Payments

Process tokenized payments from popular eWallets, including Apple Pay, Google Pay, Samsung Pay, Garmin Pay and more.

Tokenization ensures a secure and convenient payment flow in-store and online, making it essential technology for merchants and cardholders.

Point of sale:

- Contactless (NFC) payments using EMV cards, wearable payment devices, and popular mobile wallets

eCommerce:

- PCI DSS compliant customer data protection through processing of tokenized cardholder information

- Click-to-pay (Secure Remote Commerce) implementation

Acquiring API

Create and configure your entire payment acceptance infrastructure with our API. Tailor our acquirer processing services to your unique business needs and operational goals.

- Automated 24/7 MID and TID management

- Effective and transparent management of merchant and terminal IDs, legal entities, and rate plans

- Legal entity management

Omnichannel Processing

Our omnichannel processing solution is designed to provide a seamless and integrated payment processing experience across multiple sales channels.

- Integration of various sales channels into a single platform, allowing for seamless management of online, in-store POS, and mobile payments and more.

- Real-time reporting and analytics to monitor payment statuses and performance across all channels.

Payment Options

To be the go-to acquirer in your market, it is essential to provide business and consumers the most convenient payment options. Our acquirer processing service enables a wide range of payment types, helping acquirer banks and fintechs diversity and boost their merchant acquiring service.

Multiple Solutions

Stay up to date with market changes and offer multiple acquiring solutions that include the latest payment options and enable new business models:

- Mastercard MoneySend & Visa OCT

- MOTO

- Recurring billing

- One-click payments

- Pay-by-link

- Refunds & Reversals

- Dynamic Descriptor

- Airline Addendum

Any Transaction Types

Process any type of transaction supported by major payment networks with our acquirer processing services. DECTA ensures that transactions are processed quickly, securely, and reliably.

DECTA is a fully certified international payment card processor for Mastercard, Visa, and UnionPay International, a certified Third Party Processor, and a holder of ISO 9001 and ISO 27001 certificates. In combination with the most up-to-date payment infrastructure and our broad PayTech expertise, this ensures:

- Fail-proof transaction processing for in-store POS and eCommerce merchants

- 99.99% service uptime

- Secure operation at each step of the acquiring processing cycle

Payment Schemes and Currencies

Transactions can be processed from major payment schemes like Mastercard, Visa, and UnionPay International, as well as most conventional digital wallets such as Apple Pay, Samsung Pay, Google Pay, PayPal, and open banking solutions like Zimpler and Volt.

Our services support transactions in EUR, GBP, USD, and 50+ other international currencies.

How to get started?

Sign up and set the requirements

- Get in touch with us, either directly or by completing our application form. Tell us a little about your business and the solution you’re looking for.

- NOTE: This product is only available to Mastercard, Visa and UnionPay International Principal or Affiliate Members

Proposal and agreement

- From your information, we will propose a technical solution, plan implementation steps, and estimate a timeline for you.

Implementation and integration

- Our implementation team will complete all the necessary forms, solution configuration and integrations.

- *All DECTA project managers are internationally certified, have 5+ years’ experience in the Payments Industry, and will deliver every project with exceptional quality and within the best possible time frame.

Go-live

- As soon as the solution is implemented, tested and approved, you are ready for launch.

-

The price includes initial set-up and a recurring monthly maintenance fee.

* The set-up cost is calculated individually for each project and depends on your business requirements and the scope of technical work involved.

-

Yes. You need to be a licensed financial institution and a member of Mastercard, Visa, or UnionPay International in order to use the DECTA TPP services.

-

This depends on the terms and conditions of a payment network. For example, Mastercard allows 15, and Visa allows 35 chargebacks per card.